Better Investments

by better Value forecasts

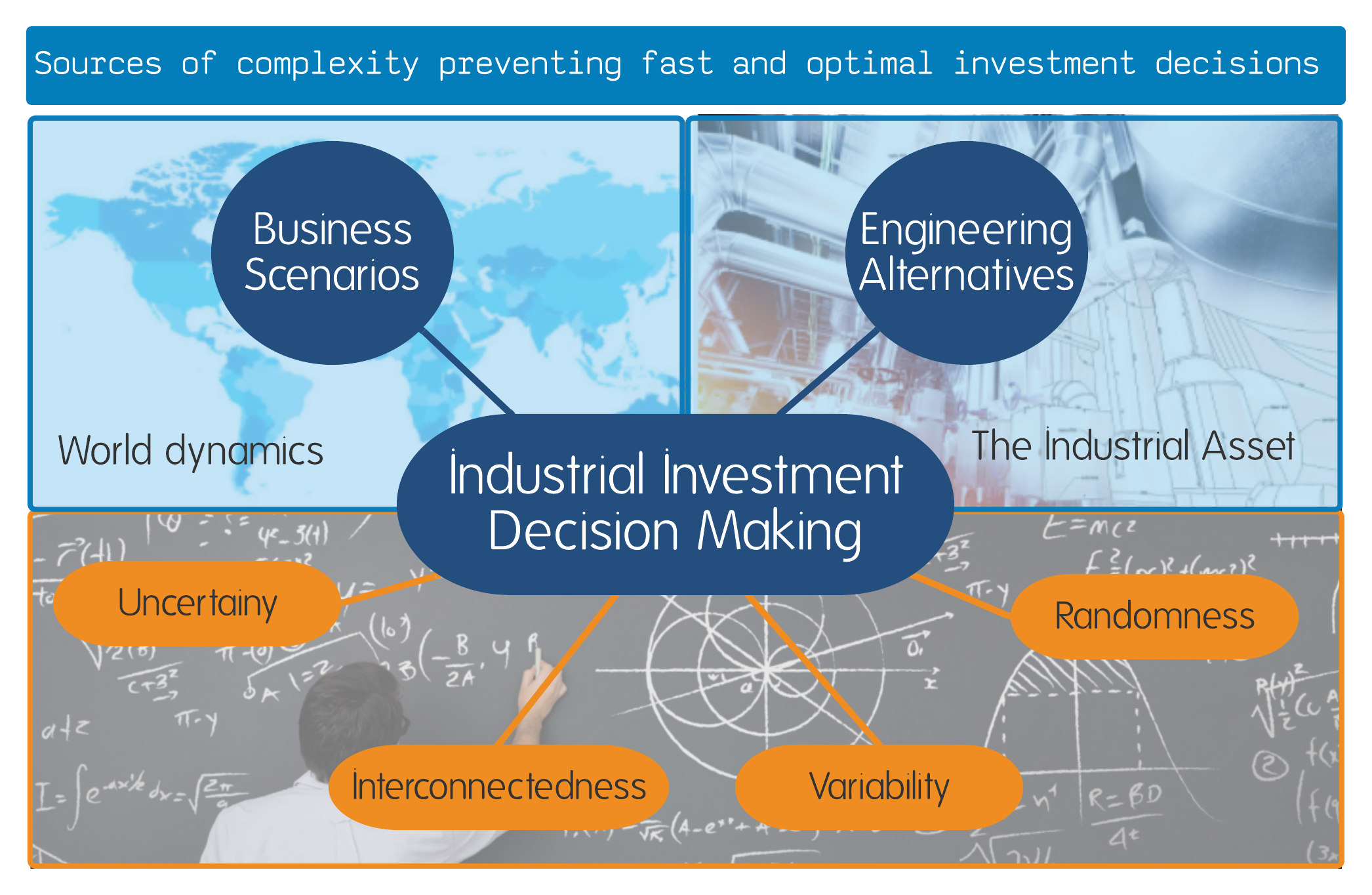

Complexity erodes quality during investment decisions, so managing analysis complexity is a must for a responsible resource stewardship

Financial managers play a central role in the society by directing financial resources to business that will generate employment, income and profit to build a better society.

Knar support such key role by providing services to address complexity associated with Industrial Investments

Let us know your questions and ideas...

The Right Decision

Every project venture comes with promises and risks, but Industrial Ventures have certain particularities natural to the associated Industrial Asset:

- What is the right technology?.

- What is the right configuration and sizing?

- Are, all those resources required upfront, or phasing investment has a lot more sense?

- Is the modularity a key element or just a nice thing to have?

- All factors affecting plant availability and performance are properly studied and understood?

- And, what may happen if this new alternative trend in the market gets wide buy-in?

- Or, this new regulation, obligating different performance targets. Is that relevant to Us?

These and so many other things, orbiting in the surrounding environment affects what will or must be considered as scope of a project aimed to create the industrial facility, and by that affect the associated investment.

Knar services for Industrial Investments allow you to do develop resources apt to decompose and solve the complexity of your very own Investment Decision.

The approach:

Provide instruments able to cope with the complexity of the decision-making process

Knar Services for supporting decision-making on industrial investments allow you to define and assess:

- Optional Business Scenarios relevant to the decision (business context, market, prices, competing alternatives, regulations, A7).

- Alternatives on configuration, sizing and consequential performance of the industrial asset.

- Modeling off all relevant sources of complexity like:

- Sources of Randomness (equipment reliability, logistics, critical supplies, maintenance).

- Sources of Uncertainty (prices for critical supplies, exchange rates, surrounding factors).

- Sources of Variability (equipment aging, efficiency of equipment, )

- Interconnectedness ( complete representation of process dependencies from end to end including externas supplies).

Computational resources developed by Knar, save you time and risks. Models evolve with you project and improve the quality and completeness of the forecast as more information is available along the life cycle of the Investment Project. You decide on the financial and technical figures to compute, or the emphasis required for tuning properly the investment.

Contact Us and let us talk on how to succeed when deciding on Industrial Investments

In the search of new business value, out of existing Industrial Assets,

Knar helps you to find it, unlock it, assuret and track it!